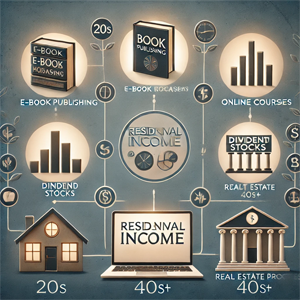

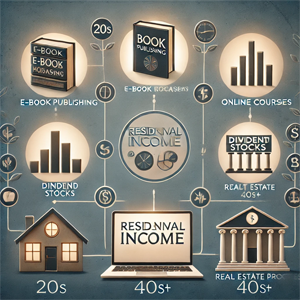

Building wealth with residual income can lead to financial freedom at any age. By developing income streams that require minimal ongoing effort, you can grow your wealth over time while focusing on other goals. Here’s a guide to help you build residual income in your 20s, 30s, and beyond, with real-world case studies that show how people have used strategies like publishing e-books and investing to achieve financial success.

Building wealth with residual income can lead to financial freedom at any age. By developing income streams that require minimal ongoing effort, you can grow your wealth over time while focusing on other goals. Here’s a guide to help you build residual income in your 20s, 30s, and beyond, with real-world case studies that show how people have used strategies like publishing e-books and investing to achieve financial success.

Residual Income in Your 20s: Laying the Foundation for Wealth

Your 20s are an ideal time to begin building residual income streams. At this stage, focus on options with low startup costs, and use your time and energy to develop skills that can create ongoing revenue.

1. Publishing E-books on Multiple Platforms

Publishing e-books is a low-cost way to generate residual income. With platforms like Amazon Kindle Direct Publishing (KDP), Apple Books, and Barnes & Noble Press, you can reach a global audience and earn royalties on each sale.

Case Study - Mia’s E-book Success on KDP and Apple Books: Mia, a recent graduate passionate about personal finance, wrote an e-book on budgeting basics. She published it on Amazon KDP and Apple Books, allowing her to tap into two different audiences. Priced at $5.99, her book generates around $250 a month in royalties. With the initial effort of writing and promoting, Mia now has a steady income that grows as her audience expands.

Tips for 20-Somethings: Choose a niche you’re knowledgeable about or interested in learning more about. Leverage social media and affordable marketing to drive traffic to your e-books across platforms, expanding your reach and maximizing royalties.

2. Starting a YouTube Channel for Ad Revenue and Affiliate Marketing

A YouTube channel offers multiple income opportunities, including ad revenue and affiliate marketing. Once you establish a following, your videos can generate income passively as they attract views and clicks.

Case Study - Alex’s Tech Review Channel: Alex, a tech enthusiast in his early 20s, started a YouTube channel reviewing affordable gadgets. By linking to products on Amazon, he earned commissions on sales. After gaining traction, he qualified for YouTube’s Partner Program, adding ad revenue to his affiliate income. His channel now generates around $500 monthly, providing a steady income without requiring constant uploads.

Tips for 20-Somethings: Focus on a specific niche to build a dedicated following. Consistent uploads and valuable content can help you establish your channel, providing income streams through ad revenue, affiliate links, and sponsorships.

Residual Income in Your 30s: Growing Your Earnings and Investments

Your 30s are often a time of financial growth, making it ideal to scale existing residual income streams and add new investments that align with your financial goals.

3. Investing in Dividend-Paying Stocks

Dividend stocks allow you to earn a share of a company’s profits while also benefiting from potential stock price appreciation. By reinvesting dividends, you can grow your investment over time.

Case Study - Sarah’s Dividend Portfolio: Sarah, a 32-year-old marketing professional, wanted to build wealth while focusing on her career. She invested in dividend-paying stocks from companies with strong track records, such as Johnson & Johnson and Coca-Cola. By reinvesting her dividends, she’s steadily growing her portfolio, which now generates around $400 in monthly dividends. With plans to continue reinvesting, Sarah is building a reliable income source that will benefit her long-term financial goals.

Tips for 30-Somethings: Choose well-established companies with a history of stable dividends. Use a dividend reinvestment plan (DRIP) to compound your earnings automatically, which can significantly grow your wealth over time.

4. Publishing Online Courses on Udemy and Teachable

If you have expertise in a specific subject, creating an online course can provide ongoing income as students enroll. Platforms like Udemy and Teachable make it easy to reach a global audience without needing to market the course yourself.

Case Study - Mark’s Marketing Masterclass on Udemy: Mark, a digital marketer, created a course on digital advertising basics for small business owners. Hosted on Udemy, his course generates steady income, averaging $600 monthly in passive earnings. Mark updates the course once a year to keep it relevant, but he continues to earn as new students enroll.

Tips for 30-Somethings: Choose a topic that addresses a specific need and provides practical value. Platforms like Udemy handle the hosting and promotion, so you can focus on creating high-quality content that will drive residual income.

Residual Income in Your 40s and Beyond: Diversifying for Long-Term Stability

By your 40s and beyond, you may have built a solid financial foundation, making this an excellent time to diversify your residual income streams and focus on stability.

5. Real Estate Investment through Real Estate Investment Trusts (REITs)

REITs allow you to invest in real estate without the hassle of property management. Many REITs focus on commercial or residential properties, and they pay out most of their income as dividends.

Case Study - John’s Real Estate Portfolio through REITs: John, a 45-year-old business owner, wanted to diversify his investments but preferred not to deal with property maintenance. He invested in a residential-focused REIT that pays quarterly dividends, providing around $500 a month in residual income. John reinvests these dividends, adding more REITs to diversify further while steadily building wealth.

Tips for 40-Somethings and Beyond: Look for REITs that focus on sectors you’re interested in, such as healthcare, commercial, or residential real estate. REITs offer a reliable income stream and can be an effective way to balance risk in a diversified portfolio.

6. Building a Membership Site or Community

A membership site can provide consistent income if you have a dedicated audience interested in exclusive content or resources. Once set up, membership sites offer residual income from monthly or yearly subscriptions.

Case Study - Lisa’s Membership Site for Fitness Enthusiasts: Lisa, a 48-year-old fitness coach, created a membership site offering exclusive workout routines and meal plans. Her site has 200 active members, each paying $20 a month, generating $4,000 in monthly income. She updates the content monthly and interacts with her community, but it requires far less work than her previous in-person classes.

Tips for 40-Somethings and Beyond: Choose a niche that offers recurring value, such as fitness, personal finance, or business coaching. Membership sites can provide consistent income as you build a community of members invested in your expertise.

Conclusion

Building wealth with residual income is achievable at any age. In your 20s, focus on low-cost, high-impact opportunities like publishing e-books or starting a YouTube channel. In your 30s, scale your income with investments in dividend-paying stocks or online courses. By your 40s and beyond, prioritize diversification with REITs or membership sites for long-term stability. These case studies highlight that, regardless of age, anyone can create residual income streams that grow over time and contribute to lasting financial freedom.

Building wealth with residual income can lead to financial freedom at any age. By developing income streams that require minimal ongoing effort, you can grow your wealth over time while focusing on other goals. Here’s a guide to help you build residual income in your 20s, 30s, and beyond, with real-world case studies that show how people have used strategies like publishing e-books and investing to achieve financial success.

Building wealth with residual income can lead to financial freedom at any age. By developing income streams that require minimal ongoing effort, you can grow your wealth over time while focusing on other goals. Here’s a guide to help you build residual income in your 20s, 30s, and beyond, with real-world case studies that show how people have used strategies like publishing e-books and investing to achieve financial success.