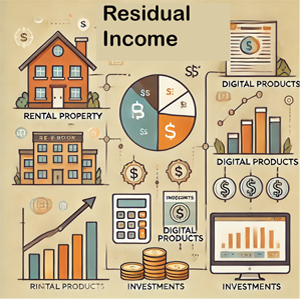

Diversifying your residual income streams is a powerful way to build financial security and maximize your earnings. By creating multiple streams, you can reduce reliance on a single source and increase the stability of your income. In this article, we’ll explore key strategies for diversifying residual income, supported by in-depth statistics and case studies of individuals who have successfully expanded their income portfolios.

Diversifying your residual income streams is a powerful way to build financial security and maximize your earnings. By creating multiple streams, you can reduce reliance on a single source and increase the stability of your income. In this article, we’ll explore key strategies for diversifying residual income, supported by in-depth statistics and case studies of individuals who have successfully expanded their income portfolios.

Why Diversification is Essential for Residual Income

Diversification in residual income helps to spread financial risk and protect against market fluctuations. Relying on a single income stream, especially in industries susceptible to economic shifts, can leave you vulnerable. The U.S. Bureau of Economic Analysis reports that households with diversified income sources are better positioned to weather financial downturns and maintain higher levels of wealth over time. According to a 2022 survey by Gallup, 57% of Americans earning residual income have multiple income streams, with an average of three. By diversifying across different sectors, such as digital products, investments, and real estate, earners can build a more robust portfolio that maximizes financial resilience and flexibility.

Step 1: Identifying Core Residual Income Streams

Before diversifying, it’s essential to establish core residual income streams that can serve as a foundation. These core streams could include dividend-paying stocks, real estate investments, or an online business.

Case Study - Anna’s Core Income Foundation in Dividend Stocks: Anna, a 40-year-old software engineer, started building residual income with dividend-paying stocks from companies like Johnson & Johnson and Procter & Gamble. Over five years, her portfolio grew to generate around $600 monthly in dividends, forming a steady income base that allowed her to diversify into other ventures.

Key Statistics: Average dividend yields range from 2-4%, with higher yields in sectors like utilities and real estate. Historical data shows dividend-paying stocks tend to perform better than non-dividend stocks during economic downturns, providing stability for investors focused on residual income. Having a reliable core income stream provides a safety net, allowing you to take calculated risks with new ventures.

Step 2: Exploring Digital Products and Content Creation

Digital products, such as e-books, online courses, and printables, have low startup costs and offer high scalability. Once created, they can generate residual income with minimal ongoing effort. Online content, such as blogging, YouTube channels, and social media, also offers income opportunities through ad revenue, affiliate marketing, and sponsorships.

Case Study - Emily’s Diversification with Digital Products and Blogging: Emily, a freelance writer, started a blog on personal finance that generated ad revenue. She later expanded by publishing an e-book on budgeting for beginners and offering a course on debt management. Her blog now brings in $500 monthly in ad revenue, while her e-book and course collectively add an additional $700 in monthly income. Emily’s diversified digital portfolio has enabled her to triple her earnings from when she relied solely on ad revenue.

Key Statistics: Global e-book revenue is projected to reach $14.16 billion in 2024, with a growth rate of 3.39% annually, according to Statista. Creators on YouTube typically earn between $3-$5 per 1,000 views, and Teachable reports that the average online course generates around $1,000 in its first month for creators with an established audience. Digital products and content creation offer flexibility, allowing you to scale and adapt based on market trends and audience preferences.

Step 3: Adding Real Estate for Stability

Real estate, including rental properties and Real Estate Investment Trusts (REITs), is a popular residual income source due to its stability and appreciation potential. Real estate income often correlates less with market volatility than other investment types, making it an effective diversification tool.

Case Study - Michael’s Real Estate Investment and REIT Portfolio: Michael, a retired teacher, purchased a duplex property and rented out one unit, generating around $800 per month. He reinvested this income into REITs focusing on residential and commercial properties. Together, his rental and REIT investments now bring in approximately $1,500 monthly, offering both steady cash flow and market diversification.

Key Statistics: Average rent prices in the U.S. have risen by 3.2% annually over the last decade, per Zillow data. REITs often yield around 4-7%, higher than the average dividend stock, which appeals to income-focused investors. Real estate has a low correlation with the stock market, providing a hedge against market downturns. Real estate adds long-term stability to a residual income portfolio, helping protect against economic swings and inflation.

Step 4: Utilizing Affiliate Marketing for Low-Cost Diversification

Affiliate marketing involves promoting products or services through unique links and earning a commission for each sale generated. This model is ideal for individuals who already have a blog, social media following, or website, as it requires minimal financial investment to start.

Case Study - Sarah’s Blog and Affiliate Marketing Success: Sarah, a travel blogger, diversified her income by incorporating affiliate marketing into her content. She joined the Amazon Associates program and added affiliate links for travel gear, such as cameras, luggage, and accessories. Her blog traffic translated into around $600 monthly in affiliate commissions, allowing her to earn without relying solely on ad revenue.

Key Statistics: Affiliate commission rates vary by niche, with average rates of 5-10% for products in travel, tech, and fashion. Nearly 71% of consumers are more likely to purchase products based on social media recommendations, making it a powerful tool for affiliate marketing. Most affiliates achieve an average conversion rate of 1-3%, with higher rates in niche-focused content. Affiliate marketing can enhance existing income streams with little upfront cost, making it a flexible option for diversification.

Step 5: Adding Peer-to-Peer (P2P) Lending for Additional Interest Income

Peer-to-peer lending platforms like LendingClub and Prosper allow investors to lend small amounts to borrowers, earning interest over time. This income stream offers competitive returns with moderate risk, especially when investments are diversified across multiple loans.

Case Study - Rachel’s Diversified Portfolio with P2P Lending: Rachel, a retired nurse, allocated $5,000 to a peer-to-peer lending account, splitting it across 100 different loans. With an average interest rate of 6%, she earns approximately $300 annually. This income, while smaller than her other streams, adds an element of diversification to her portfolio without significant management requirements.

Key Statistics: Interest rates vary, but most investors earn between 5-8% annually on diversified P2P lending portfolios. P2P lending platforms report an average default rate of 2-4%, making diversification essential for reducing risk. Many P2P platforms allow investments as low as $25 per loan, making it accessible for those starting with smaller capital. P2P lending provides residual income with a manageable level of risk and can be a valuable addition for investors looking to diversify beyond traditional assets.

Step 6: Tracking and Adjusting Your Income Streams

Diversification requires careful monitoring to ensure optimal performance. Tools like Mint, Personal Capital, or Google Sheets can help you track income, expenses, and performance metrics for each stream. By evaluating your portfolio regularly, you can make informed adjustments and reallocate funds as needed.

Case Study - Tom’s Optimization Strategy for Residual Income: Tom, a freelance photographer, started with stock photography income but gradually diversified into e-books, online courses, and affiliate marketing. Using tracking tools, he identified his top-performing sources, doubling down on the courses and reducing time spent on stock photography. This adjustment helped him maximize his monthly earnings, which now exceed $3,000 from multiple streams.

Key Statistics: Households with diversified portfolios experience 15-20% higher net worth than those with single income sources, according to data from the Federal Reserve. Around 30% of investors use financial apps to track multiple income streams, as reported by Statista. Regularly evaluating and optimizing your income streams helps ensure that your portfolio remains balanced, profitable, and aligned with your financial goals.

Conclusion

Diversifying residual income streams is an effective way to enhance earnings and build financial stability. Whether through digital products, real estate, affiliate marketing, P2P lending, or dividend stocks, each income stream contributes unique benefits that reduce financial risk and increase overall income potential. With careful planning, ongoing tracking, and periodic adjustments, a diversified residual income portfolio can help you achieve financial freedom and resilience, ensuring that your earnings remain steady regardless of market conditions.

Residual Income Planner Related Articles

- 5 Low-Risk Residual Income Investments for Beginners

- Ebook Publishing Residual Income: Pros, Cons, and Tips for Success

- How to Build a Residual Income Plan from Scratch: A Step-by-Step Guide

- How to Build Wealth with Residual Income in Your 20s, 30s, and Beyond

- How to Diversify Your Residual Income Streams and Maximize Earnings

- Passive Income vs. Residual Income: What’s the Difference and Which is Better?

- Residual Income for Retirees: How to Supplement Your Retirement Fund

- Residual Income Ideas You Can Start with Little to No Money

- The Ultimate Guide to Earning Residual Income with Affiliate Marketing

- Top 10 Residual Income Streams You Can Start Today for Financial Freedom